This distinction incentivizes investors to hold onto their securities for longer periods to minimize tax liabilities. Equity securities represent ownership in a corporation, typically in the form of stocks. Common stocks grant shareholders voting rights and potential dividends, while preferred stocks offer fixed dividends but usually lack voting rights. These securities are traded on stock exchanges, providing liquidity and the potential for capital appreciation. Investors often choose equity securities for their growth potential, although they come with higher risk compared to debt securities. Companies may also issue equity to raise capital without incurring debt, impacting their balance sheets and shareholder equity.

How Do Marketable Securities Impact a Company’s Financial Statements?

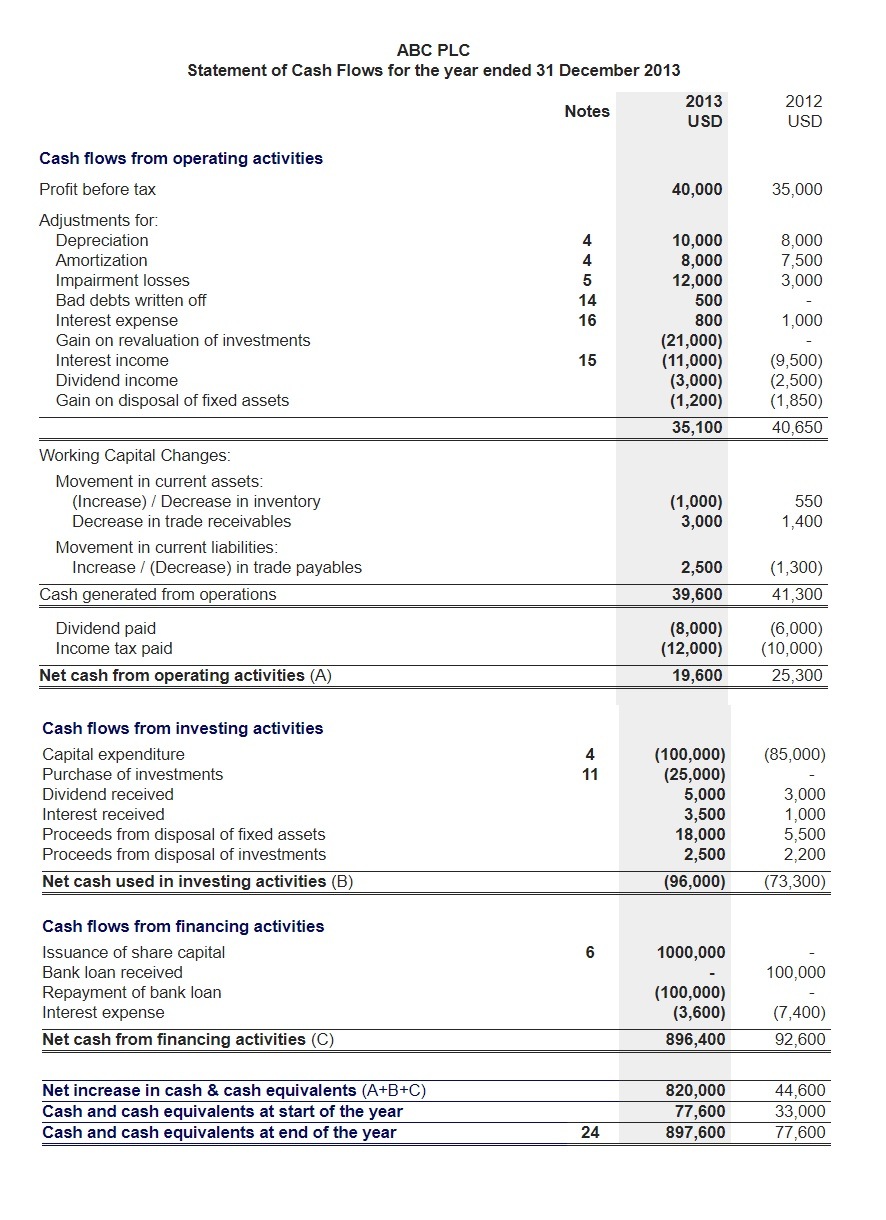

It can also result in better loan terms (due to less risk) for the company that agrees to it. Moreover, a company can benefit from the discipline of saving via cash equivalents. Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company.

- Overall Apple had a positive cash flow from investing activity despite spending nearly $30 billion on the purchase of marketable securities.

- The CFI section of a company’s statement of Cash Flows includes cash paid for PPE.

- So when we see the fair value on the balance sheet, the fair value equals what the security would be worth if the company sold it at the time of the financial statement.

- Additionally, marketable securities can be more advantageous than cash since they may generate a positive return, though this is not always the case.

Cash Ratio

Okay, let’s find where companies hold marketable securities on the balance sheet and some defining of these securities types. Companies hold public equities on the company’s balance sheet purchasing the equities, and the expectation of holding the stock is for less than one year. Explore the types, valuation methods, and financial impact of marketable securities in portfolio management. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Valuation Methods

Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. While investing in cash equivalents has its benefits, they also come with several downsides. There are several important reasons why a company should store some of its capital in cash equivalents. Transactions in CFF typically involve debt, equity, dividends, and stock repurchases.

Therefore, marketable securities are classified as either marketable equity security or marketable debt security. The return on these types of securities is low, due to the fact that marketable securities are highly liquid and are considered safe investments. The cash flow statement measures the performance of a company over a period of time. As noted above, the CFS can be derived from the income statement and the balance sheet. Net earnings from the income statement are the figure from which the information on the CFS is deduced.

Get in Touch With a Financial Advisor

If a company wants to earn some return on its money as it plans its long-term strategy, it can choose to invest some of its capital in cash equivalents. These very short-term, low depreciation of assets risk, highly liquid investments may not make a tremendous amount of money. However, they earn more than cash in a bank account and can be converted into cash quickly and easily.

Examples of marketable securities include T-Bills, CDs, bankers’ acceptances, commercial paper, stocks, bonds, and exchange-traded funds (ETFs). The activities included in cash flow from investing actives are capital expenditures, lending money, and the sale of investment securities. Along with this, expenditures in property, plant, and equipment fall within this category as they are a long-term investment in the company’s operations. Hybrid securities combine elements of both equity and debt, offering unique benefits and risks.

But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing. Money market funds are mutual funds that invest only in cash and cash equivalents. Money market funds are an efficient and effective tool that companies and organizations use to manage their money since they tend to be more stable compared to other types of funds, such as mutual funds.

Are you interested in gaining a toolkit for making smart financial decisions and the confidence to clearly communicate those decisions to key internal and external stakeholders? Explore our online finance and accounting courses and download our free course flowchart to determine which best aligns with your goals. The result is the business ended the year with a positive cash flow of $3.5 billion, and total cash of $14.26 billion. For further information regarding the net investment income, we look in the notes for Prudential under the investments note, and we find the breakdown by the security of the earnings.