Conversely, operating leverage is lowest in companies that have a low proportion of fixed operating costs in relation to variable operating costs. Return on equity, free cash flow (FCF) and price-to-earnings ratios are a few of the common methods used for gauging a company’s well-being and risk level for investors. One measure that doesn’t get enough attention, though, is operating leverage, which captures the relationship between a company’s fixed and variable costs.

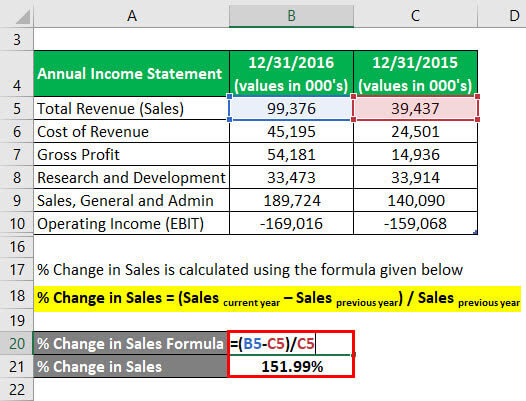

Sales Growth

This formula is the easiest to use when you’re analyzing public companies with limited disclosures but multiple years of data. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For comparability, we’ll now take a look at a consulting firm with a low DOL. An example of a company with a high DOL would be a telecom company that has completed a build-out of its network infrastructure.

What the Degree of Operating Leverage Can Tell You

Most of Microsoft’s costs are fixed, such as expenses for upfront development and marketing. With each dollar in sales earned beyond the break-even point, the company makes a profit, but Microsoft has high operating leverage. It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. For example, Company A sells 500,000 products for a unit price of $6 each.

Operating Leverage Made Easy: Formula and Examples

- Use pretax earnings because interest is tax-deductible; the full amount of earnings can eventually be used to pay interest.

- The level of scrutiny paid to leverage ratios has increased since the Great Recession of 2007 to 2009, when banks that were “too big to fail” were a calling card to make banks more solvent.

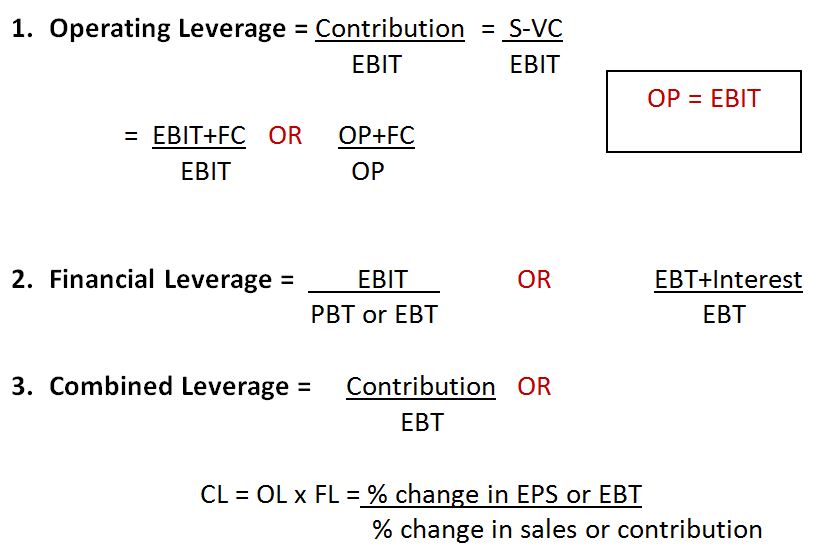

- By breaking down the equation, you can see that DOL is expressed by the relationship between quantity, price and variable cost per unit to fixed costs.

- This ratio looks at the level of consumer debt compared to disposable income and is used in economic analysis and by policymakers.

One of those primary responsibilities is knowing just how financially stable your business really is. Of course, you know if you’re making a profit, but do you know how much profit? After the collapse of dotcom technology market demand in 2000, Inktomi suffered the dark side of operating leverage. As sales took a nosedive, profits swung dramatically to a staggering what is a regressive tax $58 million loss in Q1 of 2001—plunging down from the $1 million profit the company had enjoyed in Q1 of 2000. Operating leverage can tell investors a lot about a company’s risk profile. Although high operating leverage can often benefit companies, companies with high operating leverage are also vulnerable to sharp economic and business cycle swings.

However, too much is dangerous and can lead to default and financial loss. They provide a simple way to evaluate the extent to which a company or institution relies on debt to fund and expand its operations. If a company fails to do that, it is neither doing a good job nor creating value for shareholders. Some economists have stated that the rapid increase in consumer debt levels has been a contributing factor to corporate earnings growth over the past few decades.

How is Operating Leverage Used in Business?

Companies with higher leverage possess a greater risk of producing insufficient profits since the break-even point is positioned higher. In 2023, following the collapse of several lenders, regulators proposed that banks with $100 billion or more in assets dramatically add to their capital cushions. These restrictions naturally limit the number of loans made because it is more difficult and more expensive for a bank to raise capital than it is to borrow funds. Higher capital requirements can reduce dividends or dilute share value if more shares are issued.

Either way, one of the best ways to analyze DOL results is to compare your company with those in your industry. That will help you gauge if you have a healthy metric or need to think about making some changes. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Although debt is not specifically referenced in the formula, it is an underlying factor given that total assets include debt. The second idea, industry growth, is the first resource most analysts choose when making sales predictions. The first thing we must consider is where the industry’s life cycle resides. For example, physical retail stores are in the decline phase of the cycle with the rise of internet retail. Industry growth follows an S-curve, accelerating sales early in the cycle before flattening out.