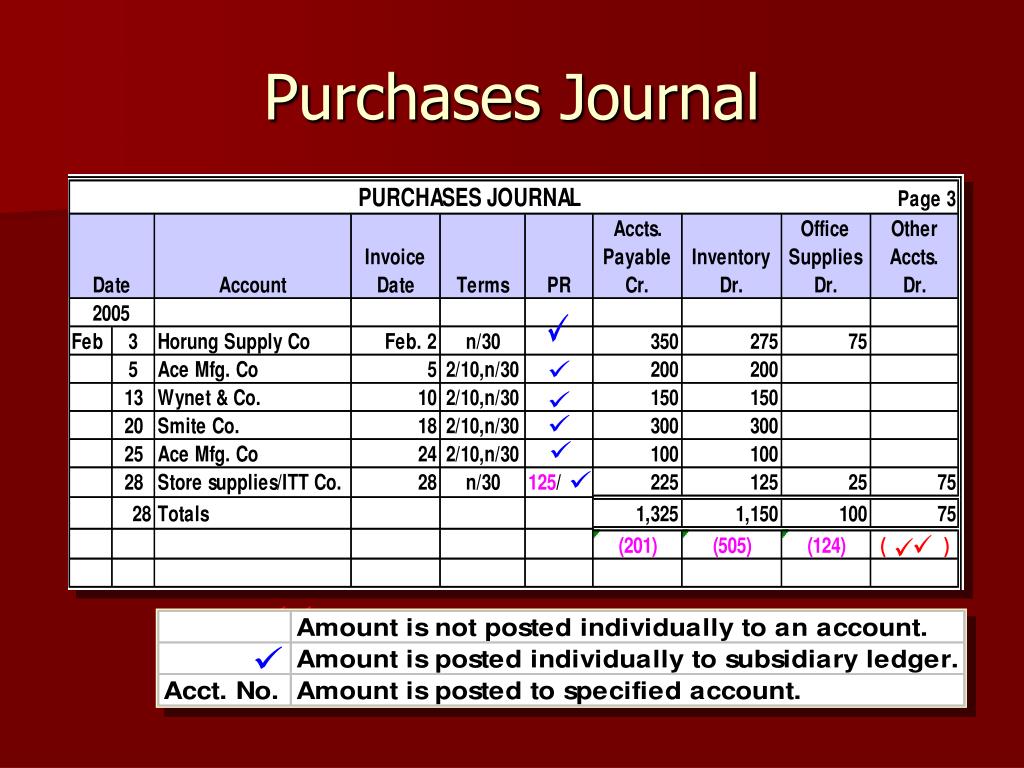

An inventory purchase journal entry records the acquisition of goods that a business intends to sell. This entry typically involves debiting the Inventory account to increase the company’s assets, showing that inventory has been added to the stock. Any transaction entered into the purchases journal involves a credit to the accounts payable account and a debit to the expense or asset account to which a purchase relates. For example, the debit relating to a purchase of office supplies would be to the supplies expense account. The journal also includes the recordation date, the name of the supplier being paid, a source document reference, and the invoice number.

Ask Any Financial Question

- The debit to the Inventory account shows an increase in assets, as the company now has more inventory.

- Notice that the total amount debited is equal to the total amount credited.

- Journal aggregation means that you summarize a period of spending from a purchase journal and add it as an entry to the general journal ledger.

There are however instances when more than one account is debited or credited. However, the payment terms are not specified in our example, so we are going to leave this section blank, as well as the reference number, which we are going to get after we post all transactions into the ledger. The two accounts involved in this transaction will get respective debit and credit entries.

Components of Purchase Journal Entry

We are assuming that a periodic inventory system is in use and that all purchases are recorded at their gross amounts. Other names used for the purchases journal are the purchases book, purchases daybook, and the credit purchases journal. In cases where the goods supplied do not match the description or have quality issues or damage, the purchaser has to return them to the supplier.

How do you record an inventory purchase in accounting?

Also, the purchase analysis extracted from these journals helps negotiate new contracts. Purchase journals also help in Creditors management, tracking returned goods status, credit notes, and dividend payout ratio definition formula and calculation updated ledger balances of Suppliers, all of which are required for a business to be successful and up to date. It also helps in audit facilitation by providing the data needed by auditors.

Recommended articles

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

What are Purchase Journals?

This entry would then be posted to the accounts payable and merchandise inventory accounts both for $2,500. Under the periodic inventory method, the credit would be to Purchase Returns and Allowances. At the end of the period, we would post the totals of $7,650 credit to cash, the $7,500 debit to accounts payable, and the $150 credit to merchandise inventory.

Both parties agree to a price that the purchaser pays in consideration of goods or services. This purchase price is the transaction amount for all purchase journals. The person or organization from whom the purchase is made is called the supplier, and when the purchase is on credit, the supplier will appear as Creditors on the balance sheet till the time payment is made. These examples highlight how inventory purchases impact a company’s accounting records, affecting both the balance sheet and cash flow, depending on whether the purchase was made in cash or on credit. After analyzing and preparing business documents, the transactions are then recorded in the books of the company. In double-entry accounting, transactions are recorded in the journal through journal entries.

This procedure helps to verify that all the postings have been made correctly. An invoice is an important document, which is an issue along with goods, and when it reaches the purchaser, the purchaser will match the goods arrived with Purchase Order placed. Included in these assets can be tangible (machinery and equipment, real property) and intangible assets (customers, technology, trade names, intellectual property, goodwill, other intangibles).

This guide serves as a foundational resource for understanding the principles and processes involved in recording inventory purchase journal entries, an indispensable aspect of accounting for inventory-holding entities. Each accounting team develops its own reporting periods for aggregation. You may balance accounting journals weekly, biweekly, or monthly, depending on your business needs.

If you are not yet familiar with the accounting elements and how each they work, see our lesson about Fundamental Accounting Concepts here. Prepare the purchase subsidiary book of Unreal Pvt Ltd. from the following details. Now that you are familiar with the meaning and format of the Purchases Journal, let’s try using it to record a sample transaction. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.