Other elements small business expense tracking are completed at certain time periods as necessary to complete a business task. If not, the trial balance contains errors which need to be located and rectified with correcting entries. It’s important to note that some errors may exist despite the debits equaling credits, such as errors caused by double posting or due to the omission of entries. The first step of the accounting process involves the preparation of source documents. A source document or business document serves as the foundation for recording a transaction.

If you’re in search of a straightforward, jargon-free guide to accounting principles, “Accounting Made Simple” is your go-to resource. Its streamlined approach makes it an invaluable tool for small business owners and anyone interested in learning accounting’s essentials. Key accounting best practices for small businesses include keeping businesses’ finances separate from personal finances, maintaining accurate records, and tracking income and expenses. Small businesses may also want to consider hiring professional accountants or automating their finances with accounting software. Diving into the mindset of the investment maestro, Brodersen and Pysh unravel the accounting methods that guide Warren Buffett’s investment strategies. By simplifying complex concepts, the authors illuminate the path to understanding financial statements from the perspective of value investing.

This book is an overview of financial accounting that describes financial statements and presents details on financial reporting requirements and compliance. Like U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Accounting for the Numberphobic by Dawn Fotopulos is another of the best accounting books for small businesses. This one focuses on accounting specifically for small business owners. Plus, it’s types of tax accounting methods written for people who may not feel comfortable around numbers. In Accounting 101, Peter Oliver unveils the core financial principles every business owner should command.

So, you might want to learn a bit about the tax process and regulations with the UK. Accounting for Non-Accountants by David Horner focuses on basic accounting principles and practices for people who are new to it. Horner goes into both financial and managerial accounting for a range of circumstances. For entrepreneurs and business owners tired of the feast-famine cycle, Michalowicz offers a refreshing approach that guarantees consistent profitability. Whether you’re a small business owner or an individual looking to manage finances better, this guide lays down the groundwork for efficient bookkeeping.

- While not explicitly an accounting book, I threw this one in for business owners unsure of the next legal step, as it touches on the legal implications of your business’ tax accounting.

- David H. Ringstrom is a certified public accountant and a recognized expert in the field of accounting software.

- Kenneth W. Boyd is a former CPA with over twenty years of accounting experience.

- Even without reading the entire book, you can use it as a reference guide to quickly find the answer to all kinds of local, state, or federal regulations.

- Accounting books are a great way to sharpen your knowledge so you can track and understand your finances like a pro.

“Wiley GAAP fillable form 940 2023” is a thorough examination and application guide of GAAP (Generally Accepted Accounting Principles). Authored by Joanne M. Flood, it may be dry, but it’s an indispensable resource for accounting professionals dealing with detailed financial reporting rules. This book serves as a comprehensive guide, delivering the skinny on bookkeeping principles and methods in a way that’s easy to understand, regardless of your business’s industry or size.

Software Cons

Because the funds are accounted for in the bookkeeping, you use the data to determine growth. A chart of accounts lists all business transaction and is used to compile statements, review progress and locate transactions. These charts have to be updated often to include various business transactions. Under the cash-basis method of accounting, you record income and expenses when cash transactions are done.

Small Business Finance for the Busy Entrepreneur: Blueprint for Building a Solid, Profitable Business by Sylvia Inks

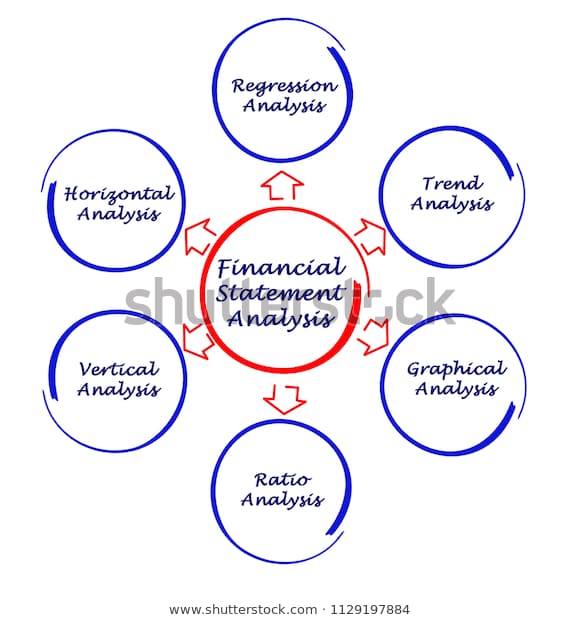

Discover a myriad of techniques and strategies that streamline the accounting process, improve accuracy, and elevate the overall efficiency of the financial function. Stig Brodersen and Preston Pysh are celebrated for their insights into value investing. Their comprehensive research and adept communication skills have made them prominent figures in the financial community. Here’s a quick summary of each book, what you’ll learn, why you should read it, and a quote I like from each book. With that said, the process doesn’t have to be complicated; if you want to understand accounting, here’s where you should start.

Option B: Get Software To Do It

The balance sheet accounts also called the permanent accounts, remain open for the next accounting cycle. A trial balance is prepared to test if the total debits equal total credits. Kenneth W. Boyd is a former CPA with over twenty years of accounting experience. Engage further with Kenneth on LinkedIn or visit his company website for additional insights and resources.

Accounting Best Practices by Steven M. Bragg

Digital bookkeeping offers a much quicker method than manual calculations. For small business owners seeking a hands-on approach to financial management, this book offers a blend of theoretical knowledge and practical tools. This comprehensive guide, crafted by the Tracy duo, serves as an invaluable tool for small business owners.