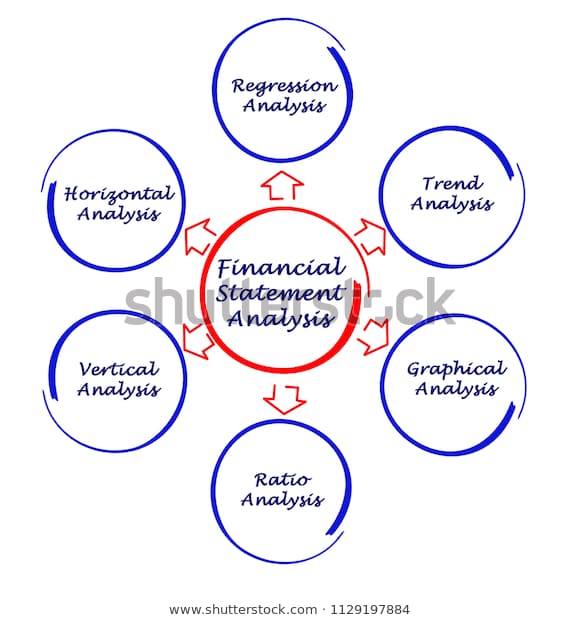

Businesses generate financial statements as an easy way to analyze metrics like YTD profit and use that information to make strategic decisions that impact the future. YTD tells us how a monetary value has progressed since the beginning of the calendar or fiscal year. That could be an investment or group of investments, a company’s accounting figure, such as sales or profit, or an employee’s earnings. These deductions are broken down and subtracted from gross earnings to arrive at net earnings, the amount transferred to the employee’s bank account. Periodically looking at the YTD returns of all assets in an investment portfolio and analyzing the findings can prompt smart and timely tweaks to holdings. Year-to-date information is used to analyze investment returns, business performance, and personal earnings.

Other terms and concepts related to YTD

In most cases, the referenced year in YTD is the calendar year, which means the period begins from January 1 till now. Reach out for a demo to learn more about how BILL can revamp your financial management and reporting. For more complicated calculations, such as interest or yield figures, you may need to turn to business finance ytd full form software for exact results.

Step 2. YTD Financials Calculation Example

It could be challenging to tell if your portfolio is on course to outperform the 8 per cent of overall returns from last year if it is up 4% as of June. For instance, a MoM revenue report can provide insights into monthly business performance trends. YTD data is also important for understanding the amount of income tax they’ll need to pay. Plus, this figure is typically included in each pay period statement until the end of the year.

Global financial markets

YTD metrics are used in rudimentary forecasting to get an estimate of where the business will be at the end of the year. MTD stands for month-to-date, covering all activity from the first day of the month to the last completed day. Businesses need to always keep a pulse on the performance to ensure they’re staying profitable and hitting their targets. You may easily calculate your Year To Date salary by adding the gross compensation from your paychecks since the year started.

- YTD sales, meanwhile, represent sales from the start of the year through to June 19.

- A running total of YTD earnings that includes gross salary, net pay, or both is typically displayed on pay stubs.

- Year-to-date information is a beneficial source for business purposes because it helps to analyse various data for specific periods and compare the updating trend in the market.

- YTD is a useful shorthand for referring to only the portion of a given period that has already passed.

Startup Founders and Operators

Track your performance over time with ClicData today and save yourself time and hassle. Both MTD and PMTD are useful in picking up and explaining quick trends in sales (sales pipeline metrics for example), marketing, financial, and any other business variables. They are most useful in businesses where keeping a handle on small daily and monthly changes is important. It is also a key metric in investing, where it is used to show the returns from an investment or portfolio. Calculating year to date expenses involves adding up all of the expenses from the beginning of the year until the current day.

Its central role is in the analysis of the data, and professional investors with much information about the finance industry frequently use it. The YTD figure is commonly seen in the financial reports of different periods, where the YTD number is frequently presented. Investors often use the YTD idea to assess and evaluate portfolio performance. Many variables play into a company’s overall financial performance, including factors such as economic conditions such as interest rates and inflation, general business conditions, and market competition. At any given point in time, however, only a few factors determine how well a company performs financially relative to its competitors.

In particular, individuals, company owners, and investors use Month-To-Date data to assess their monthly income, business profits, and investment returns. YTD is commonly used in the context of financial reporting, analysis, and performance assessment. It allows businesses to gauge their financial health, monitor progress toward annual goals, and make data-driven decisions. The Year-to-date concept has vast applications in various fields like accounts and finance.

This information would help executives understand how revenue is growing from year to year, and not just for the current season. For it to be useful, year-over-year reporting should always compare performance with a similar time period. The fiscal year is particularly significant in the year-to-date (YTD) context. Calculations –including YTD earnings and expenses – are based not on the calendar year but on the fiscal year. Thus, YTD figures reflect totals from the start of the budgetary year onwards and are featured prominently in companies’ financial statements. Companies analyze YTD information to determine if specific metrics are improving or worsening and strategic goals and objectives are being met.

Year to date (YTD) is a common phrase in finance, used to define how an investment has fared since the beginning of the year. Year-to-date balance helps in the growth and contrasting recent performance with earlier times. That’s why it is much helpful in making business strategies accordingly. Also, if the business performance is increased as compared to previous years, then year-to-date representation will assist in highlighting recent period advancements (or profits) reports.

- At the beginning of the year (Jan. 1), your holding was valued at $9,000.

- That could be an investment or group of investments, a company’s accounting figure, such as sales or profit, or an employee’s earnings.

- Knowing how much the company has spent YTD on factors such as gross pay, net pay, deductions, and benefits can help HR and payroll teams make smarter decisions.

- When you measure the performance of one metric now and compare it against a different period, you can understand what direction your business is taking and act appropriately.

Investors

Access and download collection of free Templates to help power your productivity and performance. Therefore, by holding the portfolio from January 1 to August, Colin’s year-to-date return on his portfolio is 8.117%. When the YTD is not specifically referenced to a calendar or fiscal year, it is safe to assume that the YTD is in reference to the calendar year. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

Divide these amounts by the amount of days covered in the YTD period then multiply the result by 365 (or 366 in a leap year). On top of looking at financial reporting in a completed period, here’s why you should also incorporate YTD reporting. The reasoning for choosing a fiscal year is to have a reporting period that better matches the natural business cycle. An example is schools that choose a fiscal year of July 1 to June 30 so it matches the timing of tuition payments. With a fiscal year, the business chooses the start and end date so long as it covers a 12 month period.

You do not actually include the current date in YTD reports as the business might not have closed at the time of preparation. The result is a rough forecast of what the business’s revenue and expenses will be at the end of the year. The caveat is that this won’t capture any seasonality and assumes consistent performance. YTD data is an important component of budgeting and forecasting, as well as accounting purposes. FP&A teams can compare YTD expenses to previous years to see if spending is on track or they need to adjust their annual budget. Businesses that deal with high seasonality would benefit most from incorporating MTD tracking.

This would have enabled us to compare data in these reports on a yearly basis for the given three months only. In other way, businesses would spot seasonal tendencies or anomalies by comparing these two reports. A financial year is the time period that also exists for one year, like the calendar year, but it doesn’t need to typically start on January 1st.