If they don’t match, there’s an error somewhere in the recording or posting process. As a repeatable process, the accounting cycle is important because it can help to ensure that the financial transactions during a given accounting period are accurately recorded and reported. Some steps in the accounting cycle may be automated by accounting software, though some are still done manually. If steps of the process are overlooked, an accumulation of errors could pose some issues. Inaccurate bookkeeping and the inaccurate reports generated from incorrect data could be misleading to lenders or investors, who rely on having an accurate picture of a business’s financial health. Disorganized books could eventually lead to serious legal or tax liability consequences.

Once a company’s books are closed and the accounting cycle for a period ends, it begins anew with the next accounting period and financial transactions. Once the company has adjusted all the entries as necessary, you can create financial statements. Most businesses generate balance sheets, income statements and cash flow statements. The accounting cycle is a comprehensive process designed to make a company’s financial responsibilities easier for its owner, accountant or bookkeeper to manage. The accounting cycle breaks down financial management responsibilities into eight essential steps to identify, analyze and record financial information.

Modifying the accounting cycle

For accrual accounting, you’ll identify financial transactions when they are incurred. Meanwhile, cash accounting involves looking for transactions whenever cash changes hands. A business starts its accounting cycle by identifying and gathering details about the transactions made during the accounting period. Transactions include expenses, asset acquisition, borrowing, debt payments, debts acquired and sales revenues.

The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements. Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors. The general ledger is a central database that stores the complete record of your accounts and all transactions recorded in those accounts. Making two entries for each transaction means you can compare them later. All popular accounting apps are designed for double-entry accounting and automatically create credit and debit entries.

With cash accounting, the transaction is recorded when the payment is made. With accrual accounting, the log date is the date the service is provided, received, or earned. If the debts and credits on the trial balance don’t match, the person keeping the books must get to the bottom of the error and adjust accordingly. Even if the trial balance is balanced, there still may be errors, such as missing transactions or those classified incorrectly. The accounting cycle focuses on historical events and ensures that incurred financial transactions are reported correctly.

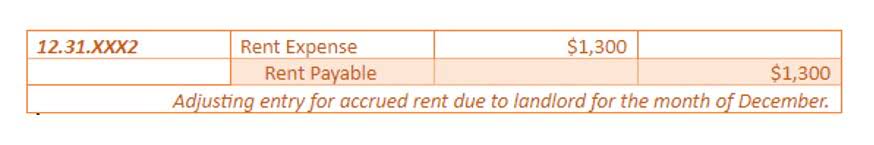

- There are some prepaid expenses and accruals that we shall need to make adjustments to at the end of the accounting period.

- As accountants identify the mistakes, they rectify the same in the worksheet to ensure debits are equal to credits.

- The main purpose of drafting an unadjusted trial balance is to check the mathematical accuracy of debit and credit entries recorded under previous steps.

- Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business.

- Recording entails noting the date, amount, and location of every transaction.

Adjusting:

At the core of HighRadius’s R2R solution lies an AI-powered platform catering to diverse accounting roles. An outstanding feature is its ability to automate nearly 50% of manual repetitive tasks, achieved through a No Code platform, LiveCube. This innovative tool replaces Excel, automating data fetching, modeling, analysis, and journal entry proposals. These are all key business activities that involve the generation of revenue and incurrence of expenses in support of revenue-generated activities.

For example, when an entity record any accruals but such an entity has not received nor issued invoices. Thus, such an entity shall need to reverse that entry at the beginning of the following period and then record actual invoices instead. For organizations seeking to optimize their financial closing processes, HighRadius’s Financial Close Management is an indispensable tool. It transforms the accounting cycle by amalgamating automation, anomaly detection, and structured project planning. Utilizing the Month End Close Checklist, organizations gain access to a detailed project plan guiding accounting teams through all necessary tasks for a seamless month-end close.

Identifying and solving problems early in the accounting cycle leads to greater efficiency. It is important to set proper procedures for each of the eight steps in the process to create checks and balances to catch unwanted errors. As a small business owner, it’s essential to have a clear picture of your company’s financial health.

In practice, steps 3, 4, 6, 7, and 9 are often automatically generated by a computerized accounting system. If you use accounting software, this usually means you’ve made a mistake inputting information into the system. Without them, you wouldn’t be able to do things like plan expenses, secure loans, or sell your business. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. We collaborate with business-to-business vendors, connecting them with potential buyers.

For example, ABC Co has recorded accrued utility expense at the end of 31 December 20×9. From past experience, ABC Co normally incurs utility expense of US$1,000 per month. However, on 5 January 202x, ABC Co received the utility bill with the actual amount of US$1,200. Below is the Balance Sheet or Statement of Financial Position after all adjusting entries have been made. Thus, any increase shall be recorded on the Debit side, and if it decreases, we shall record it on the Credit side.

- It is done by preparing an unadjusted trial balance – a list of all account titles along with their debit or credit balances.

- Next, you’ll break down (or analyze) the purpose of each transaction.

- A proper understanding of the accounting cycle provides you with a knowledge of the core activities of an accounting department.

Note that companies can perform some accounting process reconciliations like payments reconciliation automatically with AP automation software. More manual steps may be required when using a small business accounting system with limited functionality. However, the integration of third-party automation software can automate specific workflow processes to avoid preparing some manual worksheets.

Automation in Identifying and Recording Transactions

Each accountant or bookkeeper shall understand the key principle of Debits (left-hand side) and Credits (right-hand side) when they analyze transactions. If they don’t understand the rule of Debits and Credits and incorporate them into the analyzing process, they won’t be able to record transactions correctly. This rule differs for assets, liabilities, equity, revenues, and expenses. A business’s accounting period is determined by various factors, including reporting obligations and deadlines.

It serves as a clear guideline for completing bookkeeping tasks accurately. The accounting cycle vs operating cycle are entirely different financial terms. The education or student tax credits you could apply on your taxes accounting cycle consists of the steps from recording business transactions to generating financial statements for an accounting period. The operating cycle is a measure of time between purchasing inventory, selling the inventory as a product, and collecting cash from the sales transaction. An accounting process records a company’s financial transactions for an accounting period to provide accurate details to the internal and external stakeholders.

Step 6: Prepare Adjusted Trial Balance

The transactions find a proper breakdown within it, and the accounting events are easily identifiable as a separate account. It is easy to understand the accounting cycle definition with the steps involved in the process. The steps include identifying and recording transactions to use them for further collective analysis to be aware of a company’s current financial scenario. It is the responsibility of a bookkeeper to maintain and keep a check on the accounting process. Many businesses now use a virtual accounting assistant to make bookkeeping easier and faster.

Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. Check out where you can find one, along with benefits and tips to streamline your process. Discover effective strategies for maximizing efficiency through automated data extraction.

Adjust journal entries

Publicly traded firms, mandated by the SEC, submit quarterly financial statements, while annual tax filings with the IRS necessitate yearly accounting periods. The accounting cycle is the actions taken to identify and record an entity’s transactions. These transactions are then aggregated at the end of each reporting period into financial statements. A proper understanding of the accounting cycle provides you with a knowledge of the core activities of an accounting department. For example, if a company is measuring financial performance quarterly, the accounting period may open on January 1 and close on March 31.

#6 – Adjust entries

By following the accounting cycle, businesses can provide stakeholders with reliable financial information, build trust, and make informed decisions that drive long-term success. Moreover, the accounting cycle provides a framework for financial planning, decision-making, and analysis. By maintaining accurate and complete financial records, businesses can better understand their financial position and performance. This understanding allows for more effective budgeting, forecasting, and strategic planning, which are critical for achieving long-term success.